Trading Volatility+ (billed monthly):

Trading Volatility+ (billed quarterly):

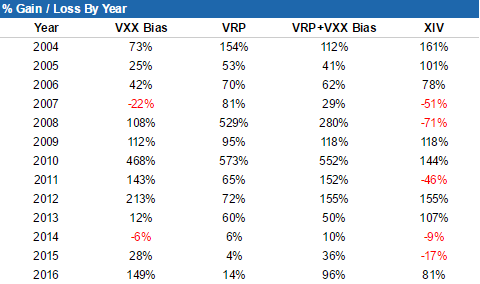

The Trading Volatility+ service provides access to our proprietary indicators for monitoring volatility ETPs, with performance in 2017 that has reached triple-digit returns, as shown by third-party auto-trading tracking. And that's on the heels of a 75% gain in 2016.

Our automated signals to buy and sell XIV and VXX grew a $100,000 reference portfolio into $353,000 since launching on the Collective2 platform in Feb 2016 (actual trade data for this system, including trade date & time stamps, share quantity and trade price is tracked by, and made available, on Collective2).

Better yet, this performance was achieved with only 26 trades, meaning you don't have to spend much of your time executing trades or excessively focusing on the market.

Our automated signals are sent to subscribers via email or text, with final alerts arriving at 4:32pm ET and preliminary alerts sent at 3:46pm ET. Subscribers also have access to our Intraday Indicators on our website which display updated indicator values throughout the trading day.

For those of you waiting for a final push to subscribe to our service, this is it. Feel more comfortable trading XIV, SVXY, VXX, and UVXY in 2018 by using proven indicators.

If you'd like to learn more about our strategies, please visit our Strategy Page or contact us via email.

Thank you and have a great Holiday Season!