Similar to XIV, SVXY is a fund that can be used as a play when an investor believes that volatility will decline. Although SVXY has only half the leverage that XIV had (-0.5x vs -1x), it can still produce strong gains and losses.

Below is a chart of the price of SVXY calculated as if it had the -0.5x leverage since 2004 (prices prior to the fund's official leverage reduction have been constructed by calculating the index value using 1st and 2nd month VIX futures data).

I've highlighted most of the larger price drops to help illustrate that SVXY is not a buy-and-hold security, even in its reduced leverage form. When the market structure changed in 2007 & 2008, SVXY still lost 70% of its value due to strong backwardation in VIX Futures.

As long-time readers know, the term structure of VIX futures is what drives various VIX funds, including SVXY, VXXB, UVXY, TVIX, VIXY, VIIX, and ZIV.

SVXY performs best in years where there is a strong and persistent contango, the condition where VIX is lower than VIX futures. The best way to measure the degree of contango for these products is to look at the weighted value of first and second month VIX futures as compared to spot VIX. Below is a graph of the weighted VIX futures values to spot VIX over the past 11 years.

The trendline here provides a way to filter out the daily noise and allows us to verify that the years in which SVXY performed the best experienced the largest and most persistent contango. On the flip side, the time frames that SVXY performed badly experienced backwardation and/or a small contango.

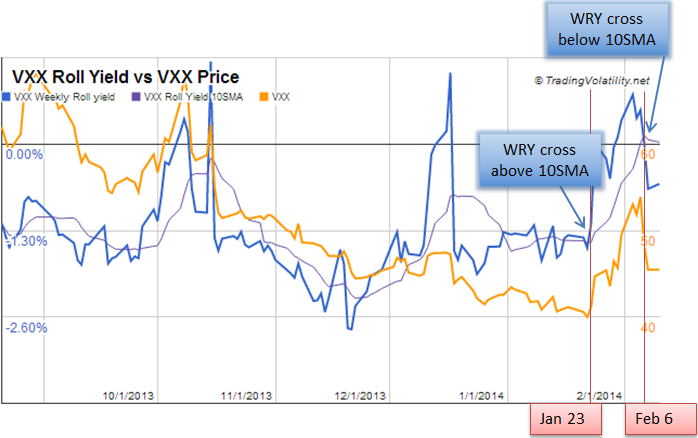

The fact that the term structure is such a strong driver of VIX ETPs is why professionals track this data closely. We track VIX Futures data and associated metrics shown on our website and use information from the term structure, price momentum, historical volatility, and the volatility of the VIX as inputs to our automated algorithms for buying and selling. The algorithm values are then used to trigger automated buying and selling of VIX ETPs and are emailed to subscribers. We track this data intraday as well and post it to both our Intraday Indicators page as well as our Daily Forecast page.

Our results (as tracked by a third party) substantially beat the S&P 500 over the long term. A screenshot of the VXX Bias and VRP+VXX Bias since we began tracking them on Collective2 are shown below:

VXX Bias:

Over the long term our approach can do well in both bull and bear markets, as seen in by our hypothetical backtest summary.

Clearly not all years are huge winners but the data shows that the use of the term structure data tends to be extremely valuable. If you are interested in checking out what we offer to subscribers you can view our Subscribe page.

One more note: We made a change to our VRP indicator in January 2019 so that it can now be used as a standalone strategy. As such, I am now having Collective2 track that as well. It can be found under Enhanced VRP.

------------

Hypothetical and Simulated Performance Disclaimer

The results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Backtest results do not account for any costs associated with trade commissions or subscription costs. Additional performance differences in backtests arise from the methodology of using the 4:00pm ET closing values for SVXY, VXXB, and ZIV as approximated trade prices for indicators that require VIX and VIX futures to settle at 4:15pm ET.