Labor Demand and Supply Under Pressure

The labor market is flashing unmistakable signs of strain:

August payrolls rose by just 22,000 jobs, the weakest monthly gain since the pandemic recovery period.

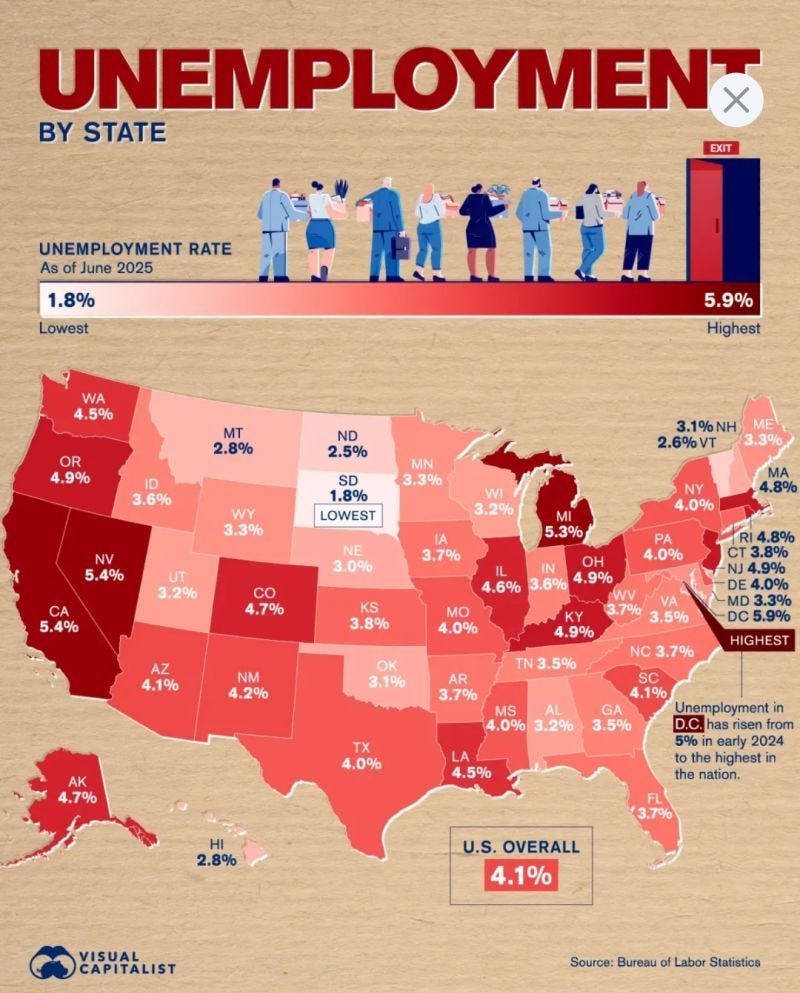

Unemployment climbed to 4.1%, the highest since 2021.

Prior months were revised downward, while goods-producing sectors in particular are showing contraction.

Looking ahead, firms are signaling caution. With cost volatility from escalating trade tensions, companies are leaning into restrained hiring, performance-based layoffs, subdued wage growth, and lower entry-level pay. We anticipate job creation will continue to weaken into 2026, with unemployment likely rising toward 4.8% by early next year.

For markets, this marks the early stages of a labor downshift driven not only by cyclical factors but also by structural disruptions from AI and automation.

Consumers: Resilient, But Eroding Fundamentals

Household spending has thus far defied the labor slowdown, but cracks are forming:

Retail sales rose 0.6% m/m in August, boosted by back-to-school shopping and activity among higher-income households.

Real volumes, however, grew only modestly, as tariffs and rising prices weigh disproportionately on lower- and middle-income households.

Tariff-induced price hikes are now filtering through, threatening to erode purchasing power.

While income gains have supported spending to date, the fundamentals are softening. Real personal consumption growth expected to decelerate from 2.8% in 2024 → 1.9% in 2025 → 1.2% in 2026, leaving consumption far more vulnerable to labor market weakness.

Inflation Reaccelerates

The August CPI confirmed a renewed acceleration in inflation:

Tariffs are beginning to lift goods prices, though passthrough remains gradual and uneven.

Service inflation stayed firm, driven by higher travel costs and a rebound in shelter.

Inflation momentum is broadening across both goods and services.

Looking forward, core PCE inflation to drift to ~3.2% by year-end, well above the Fed’s 2% target. Sticky inflation alongside labor weakness represents a difficult policy tradeoff: cut too soon, and inflation risks re-anchoring; stay tight too long, and the labor market damage deepens.

Read the rest of the article on Substack at https://tradingvolatility.substack.com/p/labor-market-weakens-inflation-reignites